AI Overview: Why Smart Businesses Are Choosing to Lease Commercial Printers

Leasing commercial printers has become the preferred choice for cost-conscious and growth-focused businesses. Rather than absorbing a steep $5,000-$35,000 upfront cost, companies can access advanced printing technology with predictable monthly payments, built-in service, and the ability to upgrade as their needs evolve.

Why Smart Businesses Are Choosing to Lease Commercial Printers

When it comes to acquiring office equipment, the decision to lease commercial printer technology has become increasingly popular among savvy business owners. But with commercial printer prices ranging from $5,000 to $35,000, the upfront investment can create serious sticker shock for any business budget.

Quick Answer: Commercial printer leasing allows businesses to:

- Access advanced technology without large upfront costs

- Preserve cash flow with predictable monthly payments ($75-$900 typical range)

- Include maintenance and service in one bundled agreement

- Upgrade equipment easily as technology advances

- Claim tax deductions on lease payments as operating expenses

As one office manager noted in our research: “When your office printer starts making that strange grinding noise again, you know it’s time for an upgrade. But looking at those price tags can give anyone sticker shock!”

The reality is that 8 out of 10 copiers are put under some kind of financing program today, with leasing being the most popular choice. This shift isn’t just about managing costs – it’s about accessing better technology, ensuring reliable service, and maintaining the flexibility to grow.

Whether you’re running a small law firm in Coral Gables, managing operations for a healthcare practice in Doral, or overseeing IT for a growing company in Fort Lauderdale, understanding your options for commercial printer leasing can transform how you approach office technology investments.

This guide will walk you through everything you need to know about leasing commercial printers, from understanding the true costs to negotiating the best terms for your Miami-area business.

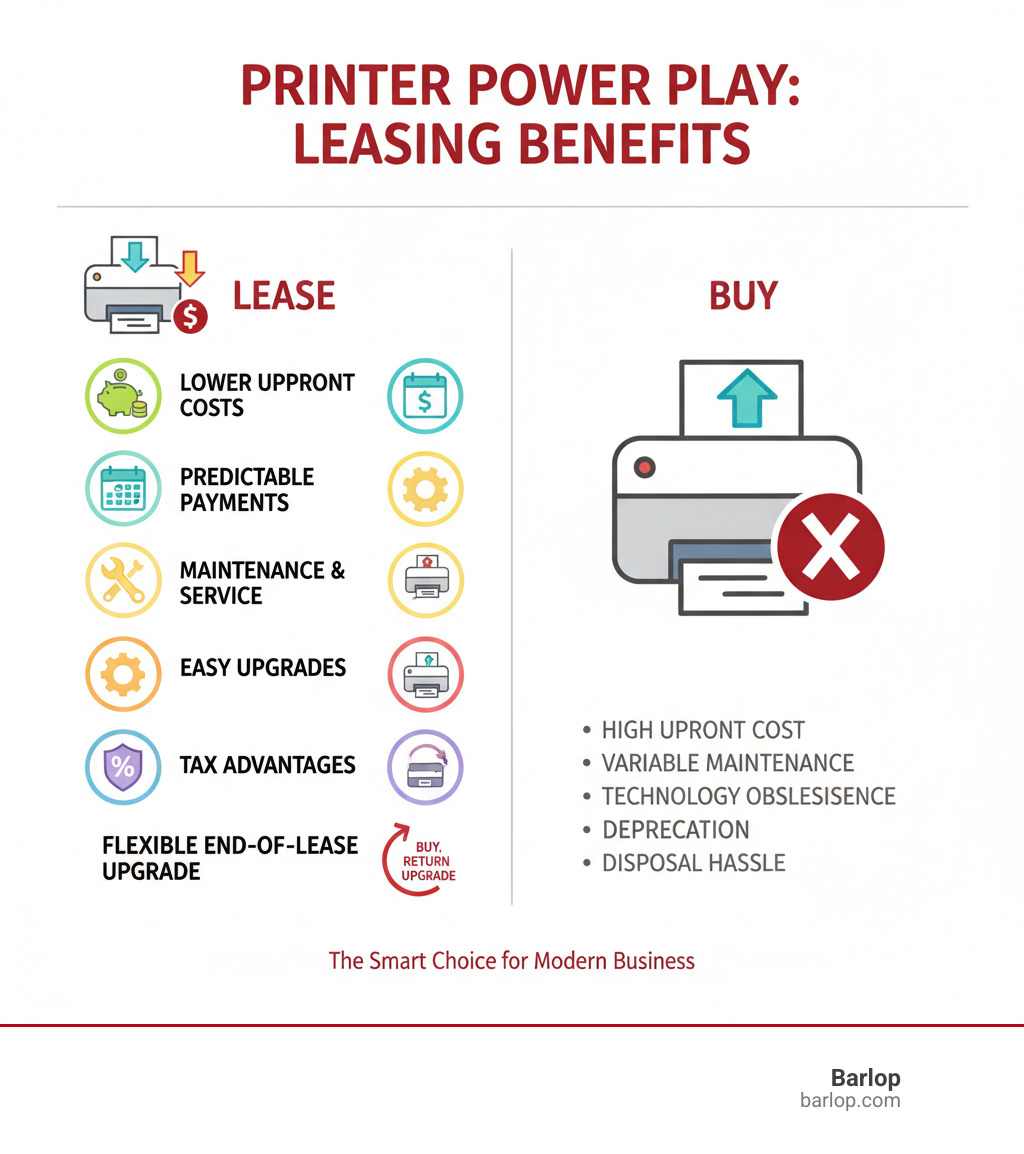

Why Lease a Commercial Printer? The Core Benefits vs. Buying

Picture this: Your marketing agency just landed a major client, and suddenly you need a high-volume color printer that can handle 75 pages per minute. The purchase price? A jaw-dropping $25,000. That kind of upfront cost could seriously impact your cash flow, potentially delaying other critical business investments.

This is where the decision to lease commercial printer equipment becomes a game-changer. Instead of that massive upfront hit, you’re looking at predictable monthly payments that preserve your working capital for growth opportunities. As we often tell our clients, The Time to Finance Office Equipment is Now.

But the benefits go far beyond just managing cash flow. When you lease commercial printer technology, you’re essentially buying yourself insurance against obsolescence. Think about how quickly technology evolves – what’s cutting-edge today might be outdated in three years. With leasing, you can upgrade to newer models at the end of your term, ensuring you always have access to the latest security features, faster print speeds, and improved efficiency.

Here’s something many business owners don’t realize: leasing often gives you access to higher-end equipment than you could afford to buy outright. That top-tier multifunction printer with advanced finishing options? It might be within reach through a lease agreement, even if the purchase price would blow your budget.

| Feature | Leasing a Commercial Printer | Buying a Commercial Printer |

|---|---|---|

| Upfront Cost | Low or none | High |

| Monthly Cost | Predictable, often all-inclusive | Variable (supplies, maintenance, depreciation) |

| Technology | Easy upgrades, access to latest models | Risk of obsolescence |

| Maintenance | Often included | Business’s responsibility |

| Ownership | No (unless $1 buyout) | Yes, but depreciates |

| Flexibility | High, easy to scale or upgrade | Low, stuck with equipment |

| Tax Benefits | Payments often fully deductible as operating expense | Section 179 deduction, depreciation |

| Cash Flow | Preserved | Significantly impacted |

The Advantages of Leasing

When you choose to lease commercial printer equipment, you’re not just getting a machine – you’re often getting a complete solution. One of the biggest advantages is bundled services. Many lease agreements include everything: maintenance, repairs, toner supplies, and even user training. What used to be unpredictable variable costs become one simple monthly payment.

Imagine never having to worry about surprise repair bills or running out to buy expensive toner cartridges. With included maintenance, when your printer starts making that concerning grinding noise, you simply call your provider. Many offer guaranteed response times – some even promise a technician within four hours. This kind of service is often part of comprehensive Managed Print Services.

The simplified budgeting aspect cannot be overstated. Instead of trying to forecast maintenance costs, supply expenses, and potential repair bills, you have one predictable monthly payment. Your CFO will love the clarity this brings to financial planning.

Perhaps most importantly, leasing offers easy upgrades. As your business grows or your needs change, you’re not stuck with outdated equipment. Technology refresh clauses in many agreements allow you to upgrade even mid-lease. This flexibility ensures you always have the most efficient, feature-rich equipment helping your business stay competitive.

By avoiding large capital expenditures, you’re also achieving reduced capital expenditure. Those funds can be reinvested into marketing, hiring, or other growth initiatives that directly impact your bottom line.

Potential Drawbacks of Leasing

While leasing offers compelling benefits, it’s important to understand the potential downsides before making your decision. The most significant concern for many businesses is the higher total cost over time. While monthly payments are manageable, the cumulative cost over several lease terms might exceed what you would have paid to purchase the equipment outright.

No asset ownership is another consideration. Unless you choose a $1 buyout lease, you won’t own the equipment at the end of the term. For businesses that prefer building equity in their assets, this can be a significant drawback.

Lease agreements come with contract obligations that typically span 12 to 60 months. These legally binding documents often include substantial early termination fees – sometimes requiring you to pay the remaining balance if you need to exit early. This lack of flexibility can be problematic if your business needs change dramatically or if you need to downsize operations.

Finally, watch out for usage limitations. Many lease agreements include monthly page allowances, and exceeding these limits can result in costly overage charges. While these limits are usually negotiable, it’s crucial to accurately estimate your print volume to avoid unexpected fees that can quickly drive up your costs.

The key is understanding these potential drawbacks upfront so you can negotiate terms that work for your specific situation and business goals.

Understanding Commercial Printer Lease Costs and Terms

When you’re ready to lease commercial printer equipment, the monthly payment is just the tip of the iceberg. Understanding what drives those costs – and what’s actually included in your agreement – can mean the difference between a smart business investment and an expensive surprise down the road.

Think of it this way: two Miami businesses might both lease similar-looking printers, but one pays $150 per month while the other pays $400. The difference isn’t just about the machine itself – it’s about understanding exactly what your business needs and how lease agreements are structured. As we’ve discussed before, What You Need to Know About Your Business Printing Costs extends far beyond that initial quote.

Your print volume is the biggest factor in determining lease costs. A small accounting firm printing 2,000 pages monthly has vastly different needs than a marketing agency churning out 15,000 colorful brochures. The higher your volume, the more robust (and expensive) the machine you’ll need.

Color versus monochrome is another major cost driver. Color capabilities typically add 20-40% to your lease payment, but for businesses that rely on professional presentations or marketing materials, it’s often worth every penny.

The required features can quickly escalate costs too. Basic printing might meet your needs today, but if you frequently find yourself running to the local print shop for scanning or copying, those multifunction capabilities could save money in the long run. Advanced finishing options like stapling, hole-punching, or booklet creation are convenient, but each feature adds to your monthly payment.

Contract length works like most financing – longer terms mean lower monthly payments but potentially higher total costs. Most commercial printer leases run 36 to 60 months, though you might find options as short as 12 months or as long as 72 months depending on your provider and creditworthiness.

Key factors that influence the cost when you lease a commercial printer

The devil is truly in the details when it comes to lease pricing. Cost-per-page charges can make or break your budget if you’re not careful. Most agreements include a base number of pages per month, then charge overages that typically range from 1-3 cents per black page and 7-15 cents per color page. Underestimate your volume, and those overage charges can double your monthly costs.

Paper size capabilities matter more than you might think. Standard letter and legal sizes keep costs reasonable, but if your business occasionally needs larger formats, understanding Understanding A4 Versus A3 becomes crucial. A3-capable machines command premium lease rates, so make sure you actually need that capability before paying for it.

Modern network and security features aren’t just nice-to-haves anymore – they’re essential for protecting sensitive business data. Features like those found in Advanced security features including HP Sure Start add to lease costs but provide invaluable protection against cyber threats and data breaches.

To put this in perspective, a basic monochrome printer for a small Fort Lauderdale law office might lease for $75-$135 monthly. Step up to a color multifunction unit for a Coral Gables marketing firm, and you’re looking at $200-$350 per month. High-volume production machines that handle 20,000+ pages monthly can reach $600-$900 monthly, but they’re built for that kind of heavy-duty work.

What’s Included in a Typical Lease Agreement?

Here’s where leasing really shines compared to purchasing. When you lease commercial printer equipment, you’re not just getting a machine – you’re getting a complete support system that takes the headaches out of office printing.

Equipment installation is typically handled from delivery to network setup. No more wrestling with network configurations or wondering if you’ve connected everything correctly. Your provider handles the technical setup so your team can focus on what they do best.

User training might seem basic, but modern commercial printers are sophisticated machines. Having your team properly trained on features like scan-to-email, secure printing, or advanced copy settings can dramatically improve productivity from day one.

Toner and supplies coverage is often the most valuable inclusion. Instead of monitoring toner levels and scrambling to order replacements, many lease agreements include automatic toner delivery. When supplies run low, new cartridges arrive before you run out – no more emergency runs to the office supply store.

Routine maintenance keeps your machine running smoothly through scheduled preventive care. Think of it like regular oil changes for your car – small investments in maintenance prevent major breakdowns later.

On-site repairs eliminate the stress of equipment failures. When something goes wrong, you make one call and a technician arrives with parts and expertise to get you back up and running. This comprehensive coverage is a cornerstone of our Service Contract approach, ensuring minimal downtime and maximum productivity for your business.

The key is getting everything clearly outlined in writing. All-inclusive agreements provide the most predictable budgeting, but make sure you understand exactly what’s covered to avoid any unwelcome surprises down the road.

Getting the best deal when you lease commercial printer equipment isn’t just about hunting for the lowest monthly payment. Think of it like choosing a business partner – you want someone reliable, transparent, and genuinely committed to your success. The right lease agreement can transform your office operations, while a poorly negotiated one can become a source of ongoing frustration and unexpected costs.

The foundation of any good lease agreement starts with finding reputable providers who have earned their stripes in the industry. Look for companies that proudly share customer testimonials and have a solid track record in your area. A quality provider will be completely transparent about their service level agreements (SLAs), including specific response time guarantees for maintenance calls. For instance, knowing that a certified technician can be at your Miami office within four hours when your critical printer goes down can mean the difference between a minor hiccup and a major business disruption.

A challenge in lease negotiations is spotting hidden fees that can quietly inflate your costs over time. These sneaky charges might include delivery and installation fees, property taxes on leased equipment, insurance requirements, or excessive end-of-lease charges. Perhaps the most dangerous trap is the automatic renewal clause – many businesses get caught off guard when their lease automatically extends for another full term because they missed the 90-day notification window. Missing this deadline can lock you into months or even years of additional payments for equipment you no longer need.

Common Hidden Costs to Watch For

Smart businesses know to dig deeper than the advertised monthly payment. Equipment delivery charges can add hundreds to your initial costs, while installation fees might not be included in that attractive base price you were quoted. Some providers also pass along property tax responsibilities to the lessee, which can vary significantly depending on your location.

Insurance requirements are another area where costs can creep up – you might need to carry specific coverage on the leased equipment. Environmental disposal fees at the end of your lease term can also catch businesses by surprise. The key is asking direct questions upfront about every possible additional cost, so you can compare true total costs between providers rather than just monthly payments.

Finding the right provider to lease a commercial printer

The difference between a great leasing experience and a nightmare often comes down to choosing the right provider. Start by checking online reviews from businesses similar to yours, paying special attention to comments about service quality and responsiveness. Don’t hesitate to ask for references – a confident provider will gladly connect you with satisfied customers in your area.

Understanding their service area coverage is crucial, especially for businesses in Miami, Miami-Dade, Broward, or Fort Lauderdale. You want a provider who can offer prompt, local support rather than having to wait days for a technician to travel from another region. Be particularly cautious of deals that seem too good to be true, as these sometimes lead to issues with unreliable service or even scams like Beware of Toner Pirates.

When evaluating potential providers, ask about what’s included in the monthly payment (toner, maintenance, parts, labor), their guaranteed response times for repairs, and their full cost structure for overage pages. Make sure you understand their early termination policies and end-of-lease options before signing anything.

Negotiating Your Lease and Understanding Your Credit

Timing can be your secret weapon when negotiating lease terms. Leasing companies often have quarterly quotas, so approaching them near the end-of-quarter can give you significant leverage for better rates or additional services. This is when sales representatives are most motivated to close deals and might be willing to offer concessions they wouldn’t consider earlier in the quarter.

Bundling equipment is another powerful negotiation strategy. If you need multiple printers or other office equipment, packaging everything together often open ups substantial discounts. Don’t be shy about asking – the worst they can say is no, but you might save thousands over the lease term.

Your business credit history plays a major role in the terms you’ll be offered. A strong credit score typically translates to lower interest rates, reduced security deposits, and more flexible contract terms. However, don’t panic if your business credit score isn’t perfect. Many providers offer options for new businesses or those with challenging credit situations.

These alternatives might include larger security deposits, co-signer arrangements, or shorter lease terms that reduce the provider’s risk. Some companies focus more on your time in business and bank account stability rather than just credit scores. The key is being upfront about your situation – many providers have creative solutions for businesses that don’t fit the traditional credit mold.

The goal isn’t just getting a printer – it’s getting the right printer on the right terms for your specific business needs. Take time to benchmark quotes from multiple providers and use competitive offers as negotiation leverage. A few hours of careful comparison shopping can save you thousands over the life of your lease.

Managing Your Lease: End-of-Term Options and Tax Implications

As our commercial printer lease term draws to a close, we’re presented with several strategic options that can significantly impact our business operations and budget. This isn’t just about what to do with an aging machine – it’s about positioning our business for continued success and making smart financial decisions.

The beauty of leasing is the flexibility it provides at the end of the term. We can choose to upgrade our equipment to newer, faster models with improved features like improved security protocols or faster print speeds. Many businesses find this appealing because technology advances rapidly, and what seemed cutting-edge three years ago might now feel sluggish. Some lease agreements even include a technology refresh clause, allowing us to upgrade mid-lease without penalties if our business needs evolve significantly.

If our current printer is still meeting our needs and running smoothly, lease renewal can be an economical choice. Often, renewal rates are lower than the original monthly payments since the equipment has depreciated. This option works particularly well for businesses with stable print volumes who are satisfied with their current capabilities.

For those considering ownership, we have two main paths. With a Fair Market Value (FMV) buyout, we can purchase the equipment at its current market value, which the leasing company determines based on factors like age, condition, and demand. Alternatively, if we originally signed a $1 buyout lease (also called a capital lease), we can own the equipment for just one dollar at the end of the term. That $1 buyout leases typically carry higher monthly payments but guarantee ownership.

Sometimes the best choice is simply returning the equipment through the equipment return process. This works well when we’re switching providers, downsizing, or moving to different technology altogether. Just be sure to understand any return conditions, such as cleaning fees or freight charges, to avoid unexpected costs.

Tax implications play a crucial role in our decision-making process. Most commercial printer lease payments qualify as operating expense deductions, meaning we can deduct the full monthly payment from our taxable income in the year it’s paid. This provides immediate tax benefits and improves our cash flow.

For purchased equipment, we might use the Section 179 deduction, which allows businesses to deduct the full purchase price of qualifying equipment (up to annual limits) in the year it’s placed into service. The choice between an operating lease (which keeps equipment off our balance sheet) and a capital lease (treated more like a purchase for accounting purposes) also affects our financial statements and tax situation. We always recommend consulting with a tax professional to understand the specific financial benefits for our unique situation.

The Value of an All-Inclusive Service Agreement

An all-inclusive service agreement transforms our printing experience from reactive problem-solving to proactive business support. When our printer is humming along smoothly, we barely think about it – and that’s exactly how it should be.

Reduced downtime is perhaps the most valuable benefit. With proactive maintenance visits scheduled regularly, potential issues are caught and resolved before they become major problems. Instead of finding a critical malfunction right before an important presentation, we benefit from technicians who spot worn parts during routine check-ups and replace them preventively.

This proactive maintenance approach extends far beyond simple repairs. Technicians clean internal components, calibrate color settings, update firmware, and ensure optimal performance. It’s like having a personal mechanic for our printer who keeps everything running at peak efficiency.

Having a single point of contact eliminates the frustration of juggling multiple vendors. No more calling one company for toner, another for repairs, and a third for maintenance questions. When something needs attention, we make one call to our trusted partner who handles everything seamlessly.

Simplified invoicing brings welcome predictability to our monthly expenses. Instead of surprise repair bills, separate supply orders, and various service charges, everything rolls into one comprehensive monthly payment. This makes budgeting straightforward and eliminates the headache of tracking multiple vendor payments. Our Photocopier Service Repair Miami service exemplifies this approach, providing South Florida businesses with reliable, consolidated support.

Planning for the End of Your Lease

Smart lease management begins long before the expiration date appears on our calendar. Starting our evaluation process about six months before lease termination gives us the breathing room to make thoughtful decisions rather than rushed ones.

This evaluation window is perfect for conducting a thorough re-assessment of our business needs. Has our print volume increased significantly? Do we now need color capabilities we didn’t require before? Are security features more critical than they were three years ago? A comprehensive evaluation, like those detailed in What is a Print Assessment? Why Should Every Business Get One?, helps us understand exactly what we need going forward.

Notifying the leasing company within the required timeframe is absolutely critical. Most agreements require written notice 90 days before expiration, and missing this deadline can trigger automatic renewal for another full term. We’ve seen businesses accidentally locked into unwanted lease extensions simply because they forgot to provide timely notice. Setting multiple calendar reminders is a small step that prevents big headaches.

During this planning period, we can explore all our options thoroughly. This means getting renewal quotes from our current provider, researching upgrade possibilities, and even seeking competitive bids from other companies. Having multiple options gives us negotiating leverage and ensures we’re making the most cost-effective choice for our business.

By planning ahead, we maintain control over our printing solutions and avoid the stress of last-minute decisions. This proactive approach ensures our office technology continues supporting our business goals seamlessly, whether that means upgrading to the latest features or finding the most economical path forward.

Frequently Asked Questions about Commercial Printer Leasing

When businesses across Miami-Dade, Broward, and Palm Beach counties consider their printing options, we hear the same thoughtful questions again and again. These concerns are completely natural – after all, choosing to lease commercial printer equipment is an important business decision that affects your budget, operations, and technology capabilities for years to come.

Let’s address the most common questions we encounter, drawing from our experience helping hundreds of South Florida businesses find the right printing solutions.

What types of businesses are best suited for leasing a commercial printer?

The beauty of commercial printer leasing is its versatility, but certain business profiles particularly thrive with this approach. Startups and small to medium businesses often find leasing transformative because it eliminates the crushing upfront costs that can strain limited capital. Instead of writing a $15,000 check for a high-end multifunction printer, these businesses can preserve their cash flow and invest those funds in marketing, inventory, or hiring.

Businesses with fluctuating print needs represent another sweet spot for leasing. Think about a tax preparation firm that's swamped from January through April but relatively quiet the rest of the year, or a marketing agency that lands a massive client requiring thousands of color brochures. These companies benefit enormously from the flexibility to upgrade or adjust their printing capacity as demands change.

Companies that prioritize staying current with technology also gravitate toward leasing. In today's fast-moving business environment, having access to the latest security features, fastest print speeds, and most efficient energy consumption can provide a real competitive edge. When you own a printer, you're stuck with yesterday's technology until you're ready to make another major purchase.

Finally, specialized industries like legal firms, healthcare practices, and creative agencies often require specific capabilities - whether that's secure document handling, high-resolution color reproduction, or advanced scanning features. Leasing ensures these businesses can access exactly the right equipment without the financial burden of ownership.

Are commercial printer lease payments tax-deductible?

This is perhaps our most frequently asked question, and for good reason - the tax implications can significantly impact your bottom line. The short answer is yes, commercial printer lease payments are typically fully tax-deductible as business operating expenses in the year they're paid.

For most businesses, this means every monthly payment reduces your taxable income dollar-for-dollar. If you're paying $300 monthly to lease commercial printer equipment, that's $3,600 annually that comes directly off your taxable income. Compare this to purchasing, where you might depreciate the equipment over several years or use Section 179 deductions with their various limitations and requirements.

The tax treatment does depend on your lease structure. Operating leases - the most common type - are treated as rental expenses and offer the clearest path to full deductibility. These leases keep the equipment off your balance sheet and provide the most straightforward tax benefits. Capital leases (like $1 buyout options) are treated more like purchases for tax purposes, which may involve depreciation schedules rather than direct expense deductions.

However, tax laws can be complex and change over time. We always recommend consulting with your accountant or tax professional to understand how leasing fits into your specific financial picture. They can help you maximize your tax advantages while ensuring compliance with current regulations.

What happens if my print volume changes significantly during the lease term?

Business rarely stays static, and your printing needs probably won't either. The good news is that most leasing arrangements are designed with this reality in mind, offering several paths forward when your volume changes dramatically. When print volume increases significantly, you'll initially encounter overage charges for pages beyond your monthly allowance. While these charges (typically 1-3 cents for black and white, 7-15 cents for color) might seem manageable at first, they can quickly add up. The smart move is to contact your leasing provider proactively. Most reputable companies will renegotiate your monthly allowances or help you upgrade to a higher-capacity machine that better matches your new reality. Decreasing print volume presents different challenges but similar solutions. Many businesses finded this during the pandemic when remote work dramatically reduced office printing. Some companies saw print volumes drop by 60% or more virtually overnight. In these situations, leasing providers often work with businesses to adjust allowances downward or even facilitate equipment downgrades, though fees may apply. The key to managing volume changes successfully is proactive communication with your provider. Don't wait until you're facing thousands in overage charges or paying for capacity you no longer need. A good leasing partner views your success as their success and will work with you to find flexible solutions that adapt to your changing business environment. This flexibility is one of the primary advantages of leasing over purchasing. When you own equipment, you're stuck with whatever capacity you bought, regardless of how your needs evolve. With a lease, you have options and a partner invested in helping you find the right solution.

Conclusion

It’s about making a strategic investment in your business’s future. Throughout this guide, we’ve uncovered how leasing transforms what could be a significant financial burden into a manageable, predictable expense that actually strengthens your operational foundation.

Think about it: when you choose to lease commercial printer technology, you’re not just getting a machine. You’re gaining financial flexibility that keeps your cash flow healthy, operational efficiency through bundled maintenance and service, and technological agility that ensures you’re never stuck with outdated equipment. These advantages become even more valuable when you consider that most businesses significantly underestimate their long-term printing needs and technology requirements.

The businesses we work with in Miami, Fort Lauderdale, and throughout South Florida consistently tell us that leasing has allowed them to stay competitive in ways they never expected. A small law firm can access the same high-security, high-speed printing technology as a large corporation. A growing marketing agency can scale their printing capabilities alongside their client base without major capital investments. A healthcare practice can ensure HIPAA-compliant document handling without the headache of managing complex equipment purchases.

What makes the difference between a good leasing experience and a great one? It’s understanding the details we’ve covered—from recognizing hidden fees and automatic renewal clauses to planning your end-of-lease strategy well in advance. It’s asking the right questions upfront and choosing a provider who sees your success as their success.

At Barlop, we’ve built our reputation on exactly this kind of partnership approach. We understand that your printing needs are as unique as your business, and we’re committed to finding solutions that truly fit. Whether you’re dealing with fluctuating print volumes, need specialized features, or simply want the peace of mind that comes with comprehensive service coverage, we’re here to guide you through every step of the process.

The decision to lease commercial printer equipment isn’t just about managing costs—it’s about positioning your business for growth, efficiency, and long-term success. When you’re ready to explore how flexible leasing options can transform your printing operations, we invite you to review our Copier Printer Lease solutions. Let’s work together to find the perfect printing solution that grows with your business and supports your goals for years to come.