Barlop Business Systems Spotlighted Once again in South Florida Business Journal as Top 25 Cloud Solutions Provider and one of the Top 100 Privately Owned Companies in South Florida

Barlop Business Systems Spotlighted Once again in South Florida Business Journal as Top 25 Cloud Solutions Provider and one of the Top 100 Privately Owned Companies in South Florida October 29, 2022– Barlop Business Systems, a leading managed technology services […]

reminder to business owners to reinvest before december 31st.

What Is Section 179?

Section 179 of the U.S. internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment instead of capitalizing and depreciating the asset over a period of time. The Section 179 deduction can be taken if the piece of equipment is purchased or financed and the full amount of the purchase price is eligible for the deduction.

Barlop Business Systems Helps Companies Transition From Old Phone Systems That Hindered Remote Worker Performance

Leading MTSP’s Cloud Voice Solution Maximizes Communication and Productivity of Remote Workers Barlop Business Systems, a leading managed technology services provider (MTSP), announced today that the company is helping small to mid-sized businesses (SMBs) transition from outdated business phones that […]

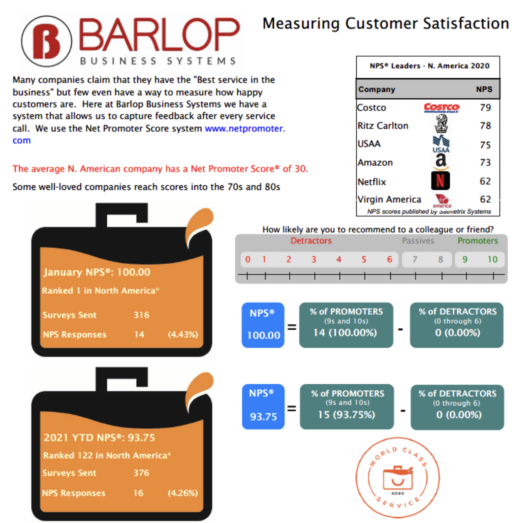

NPS Awards: World Class Service

Measuring Customer Satisfaction Many companies claim that they have the “Best Service in the Business” but few even have a way to measure how happy customer are. Here at Barlop Business Systems we have a a system that allows us […]

Is your team ready for Windows 11?

MIAMI, FL – December 27, 2021 – Barlop Business Systems, a leading managed technology services provider (MTSP), is preparing small to mid-sized businesses (SMBs) to upgrade their operating systems to run on Windows 11, as it is the latest operating system to be […]

Barlop Business Systems Alerts Customers About Section 179 Tax Advantage End of Year Deadline

Leading MTSP Reminds Business Owners to Reinvest Before December 31st MIAMI, FL – November 16, 2021 – Barlop Business Systems, a leading managed technology services provider (MTSP) is alerting local businesses about Internal Revenue Code (IRC) 179 and the deductions it affords […]

Barlop is proud to be recognized a GREAT PLACE TO WORK 2021!

https://barlop.wpenginepowered.com/wp-content/uploads/2021/11/6d01803adeac4f24b118f512c9691f3b.mov Great Places to Work uses Research backed technology, decades of research and consulting, proven model and methodology by using Our Trust Index Survey to research each Businesses’ Company Culture. Each employee at Barlop took the survey and gave anonymous […]

Our Annual Halloween Contest is back!

This year our theme was movies. Toy story and Back to the Future were picked. We had so much fun preparing and working together to create this team event. We also celebrated our October Babies birthday with a homemade cake […]

Barlop Business Systems Shares 3 Best Practices for Thwarting Phishing Attacks

https://vimeo.com/461623283 Leading Provider in Managed Technology Services Teaches Cyber Security Prevention Measures MIAMI, FL — October, 2021 – Barlop Business Systems, a leading managed technology services provider (MTSP), is helping small to mid-sized businesses (SMBs) thwart cyberattacks and protect their […]

Malware is Running Rampant – Learn The 3 Moves to Stop It

https://vimeo.com/461623283 Barlop Business Systems Helps Customers Protect Their Precious Networks MIAMI, FL — August 12, 2021 – Barlop Business Systems, a leading managed technology services provider (MTSP), proactively helps businesses address the increased threat of malware affecting small to mid-sized […]