We wanted to be sure all Business Owners and Buyers are aware of theSection 179 tax savings that was just announced. According to the IRS, now is the time to buy!

Under Section 179 deduction in the tax code, in 2021, businesses can write off the entire purchase of price of qualifying equipment for their current tax year. While some expenses are unnecessary, it is clear that Technology in the workplace is essential. With the right technology and solutions your business can thrive, be more productive, profitable and efficient! Section 179 is very beneficial to small businesses especially in today’s times.

If you are a business owner or purchaser that has been struggling between the decision to purchase new equipment or remain financially conservative, we may just be able to help you make that right decision. Click Here for a Representative to contact you

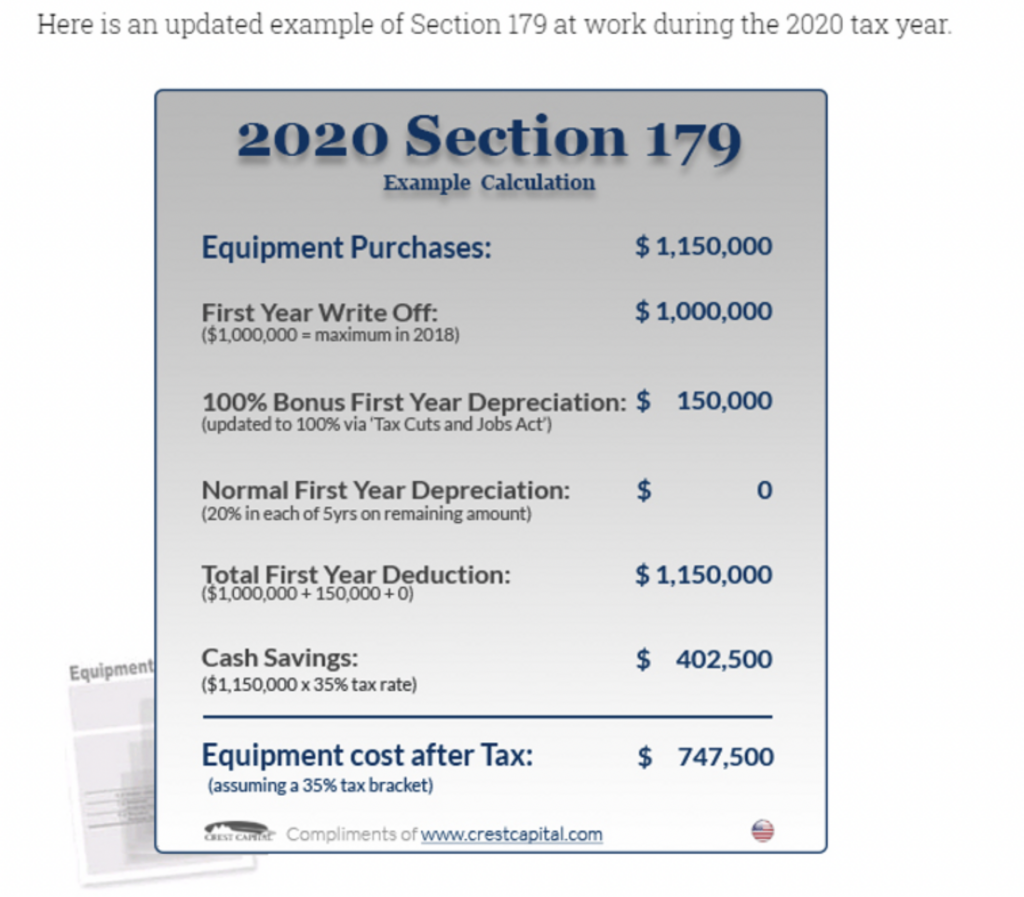

What is the Section 179 Deduction? Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 is more beneficial to small businesses than ever. Today, Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits.

Barlop : Section 179 does – allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2021 should qualify for the Section 179 Deduction (assuming they spend less than $3,630,000).

Most tangible goods used by American businesses, including “off-the-shelf” software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction.

For 2021, $1,040,000 of assets can be expensed; that amount phases out dollar for dollar when $2,590,000 of qualified assets are placed in service.