A copy machine lease can significantly impact your office operations and budget. With lease payments ranging from $50 to over $1,000 per month, the right choice affects both your cash flow and productivity.

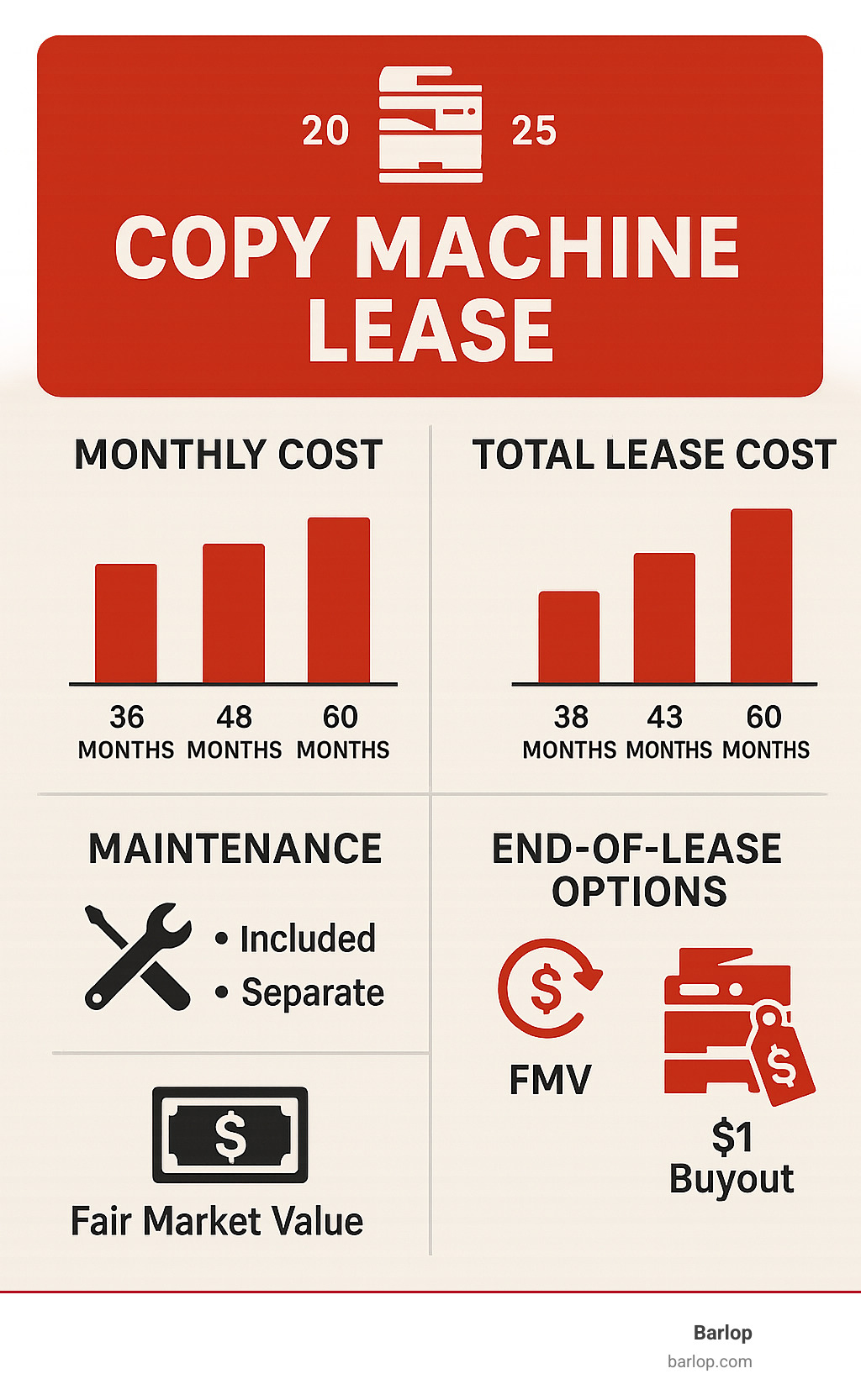

Key copy machine lease options include:

- 36-month lease: Lower total cost, higher monthly payments

- 48-month lease: Balanced payment and total cost

- 60-month lease: Lowest monthly payment, highest total cost

- Fair Market Value (FMV): Return or buy at market value at lease end

- $1 Buyout: Own the equipment for $1 at lease end

Most businesses lease copiers to preserve capital and bundle maintenance costs. The challenge is navigating lease terms and selecting equipment that matches your print volume. Poor planning can lead to overage charges or paying for unused features. A $10,000 copier might cost $12,500 over a 60-month lease, highlighting the importance of a well-structured agreement.

Your lease decision affects everything from budget planning to technology upgrades. Getting it right means predictable costs and reliable service, while a poor choice can lock you into an expensive, ill-fitting contract.

Leasing vs. Buying: A Financial and Operational Comparison

Choosing between leasing and buying a copier affects your finances and operations differently. Buying is a large, one-time capital expense, while leasing involves spreading the cost into predictable monthly payments. Understanding which approach matches your business goals is key.

Benefits of Leasing

A copy machine lease requires little to no money down, preserving cash for other business needs. This approach also simplifies technology upgrades. As copiers evolve with faster scanning and better security, a lease allows you to easily acquire the latest model when your term ends, preventing technology obsolescence.

Most lease agreements bundle the equipment, maintenance, repairs, and toner into a single monthly payment. This eliminates surprise repair bills and simplifies budgeting, as one call typically resolves any service issues.

Benefits of Buying

Buying a copier means you own it outright with no monthly payments or usage restrictions. Over the long term, buying is often cheaper because you avoid the finance charges built into lease payments. A copier that costs $10,000 to buy might cost $12,500 over a 60-month lease.

The tax benefits of buying can also be significant. Under Section 179, you may be able to deduct the entire purchase price in the year of the purchase, a much larger initial deduction than writing off monthly lease payments.

Comparing Leasing vs. Buying

| Feature | Leasing a Copier | Buying a Copier |

|---|---|---|

| Upfront Cost | Low or none, preserves capital | High capital expenditure |

| Total Cost of Ownership | Higher over the long term due to finance charges | Lower over the long term, avoids finance charges |

| Maintenance Responsibility | Often included in lease agreement | Separate service contract or pay-as-you-go |

| Technology Upgrades | Easy upgrades at lease end | Equipment becomes outdated, costly to replace |

| End-of-Term Options | Return, upgrade, or buy at fair market value | Keep using or sell/dispose when ready |

The decision depends on your priorities. If preserving cash flow and accessing current technology are most important, leasing is often the better choice. If minimizing long-term costs is the goal, buying may be preferable. Most businesses find leasing works better, which is why 8 out of 10 copiers are leased rather than purchased outright.

Once you decide to lease, understanding the agreement is crucial to avoid future issues. Lease contracts contain industry jargon and clauses with hidden costs, but knowing the key components will help you secure a favorable deal.

Choosing the Right Lease Term

The lease term affects both your monthly payment and total cost. Most providers offer three main options:

- A 36-month lease has higher monthly payments but a lower total cost. It is the most popular choice, especially for Fair Market Value leases, as it allows for more frequent technology upgrades.

- A 48-month lease offers a balance between a manageable monthly payment and a reasonable commitment period, making it a good middle-ground option.

- A 60-month lease provides the lowest monthly payment, which is attractive for cash flow. However, it typically results in the highest total cost over the five-year term.

When choosing, consider how quickly your business and technology needs might change.

Key Clauses and Negotiation Points

Understanding the fine print gives you negotiating power. The most important choice is between a Fair Market Value (FMV) and a $1 Buyout lease.

An FMV lease is essentially a long-term rental. It has lower monthly payments, and at the end of the term, you can return the copier or buy it for its market value. A $1 Buyout lease functions more like a financing agreement. Monthly payments are higher, but you own the equipment for one dollar at the end, making it a good choice if you plan to keep the machine long-term.

Pay close attention to the evergreen clause, which can automatically extend your lease if you fail to provide proper notice of termination. Always push to remove this clause or, at a minimum, understand the notification requirements. To avoid automatic renewal, you must send a Letter of Intent, typically 90 to 120 days before the lease ends, stating your plans. Mark this date on your calendar.

Also, negotiate for written performance guarantees to ensure the copier works as promised. Clarify if installation and training fees are included or billed separately. Finally, consider keeping the maintenance agreement separate from the lease. Bundling them can lead to annual increases on the entire payment, while a separate contract gives you more control over service costs.

Typical Costs Associated with a Copy Machine Lease

Beyond the base monthly rate, which can range from $49 to several hundred dollars, other costs will affect your budget.

Most leases include a monthly copy allowance (e.g., 2,000 to 7,500 copies). Exceeding this allowance results in overage fees, which are about a penny per page for black and white but significantly more for color. Accurately estimating your print volume is critical to avoid these extra charges. Some providers offer quarterly allowance reviews.

Maintenance contracts cover service, parts, and supplies like toner, but typically not paper and staples. Always clarify what is included to get a clear picture of the true cost of your lease.

Selecting the Right Copier and Services

Choosing the right copier involves more than the monthly payment; it’s about finding equipment and services that support your daily operations. Today’s machines are multifunction devices that print, scan, copy, and fax, so it’s important to match features to your actual needs.

Types of Copiers and Essential Features

First, decide between monochrome and color. If you primarily print internal documents or invoices, a monochrome machine is more cost-effective. For marketing materials or presentations, color is essential.

Speed, measured in pages per minute (PPM), should match your workload. A 20-30 PPM machine is sufficient for most small offices with a volume of 3,000-5,000 pages monthly. Larger offices may need a 40-70 PPM model. Focus on your actual workflow, not theoretical maximums.

Modern scanning capabilities like scan-to-email, scan-to-folder, and scan-to-cloud can digitize your workflow. Optical character recognition (OCR) is another valuable feature that converts scanned images into editable text.

Ensure the copier has reliable network connectivity (Ethernet or wireless) to fit your office setup. Security features are also crucial, including user authentication, data encryption, and secure print release to protect sensitive information. For offices that copy or scan multi-page documents, an automatic document feeder is a must-have time-saver.

New vs. Certified Pre-Owned

You can lease either new or certified pre-owned equipment. New copiers offer the latest technology and a full manufacturer’s warranty but come with higher lease payments. This is often the best choice for businesses that need the newest features or depend heavily on their machine.

Certified pre-owned copiers are a budget-friendly alternative, offering savings of 50% or more. These machines are refurbished and tested to meet performance standards and are backed by the leasing company’s warranty and service agreement. A pre-owned machine might lease for $100 per month, while its new counterpart could be over $200. This is a great option for businesses with moderate needs or those looking for professional equipment at a lower price point.

Additional Services and Add-Ons

Many leases offer services that improve office productivity. Finishing options like staplers, hole punchers, and booklet makers can automate document production for reports and proposals.

Remote monitoring allows your provider to track toner levels and machine status, often resolving issues proactively. Some systems even order supplies automatically. Same-day support guarantees a quick response when your copier breaks down, minimizing downtime.

Supply management services ensure you never run out of toner by shipping consumables based on your usage. Some providers also offer managed print services, which analyze your entire printing environment to find efficiencies and reduce overall costs. The key is to select a balance of features and services that you will actually use.

What Happens When Your Lease Ends?

The end of a copy machine lease presents several clear paths forward. Planning ahead and understanding your options is essential, as most lease agreements have strict deadlines for notifying the leasing company of your intentions. Missing these can trigger costly automatic renewals.

Return the Equipment

Returning the copier is the simplest option if you plan to switch providers or no longer need the machine. The most critical step is sending a Letter of Intent, a formal notice that you plan to return the equipment. Most agreements require this letter 90 to 120 days before the lease expires.

Failing to send this notice on time can trigger an evergreen clause, which automatically extends your lease for months or even a year, often at a higher rate. When it’s time to return the machine, you will likely be responsible for packaging it and covering shipping costs. The leasing company will inspect it for any damage beyond normal wear and tear, which could result in additional charges.

Purchase the Copier

If the copier meets your ongoing needs, purchasing it can be a good choice. With a Fair Market Value (FMV) lease, you can buy the equipment for its current value as determined by the leasing company. This price reflects the machine’s age and condition.

If you have a dollar buyout lease, you simply pay one dollar to take ownership. These leases have higher monthly payments but guarantee ownership at the end. Once you purchase the copier, you become responsible for arranging your own maintenance and service.

Upgrade or Renew

The end of a lease is an excellent opportunity to upgrade to a machine with better speed, security, or efficiency. A technology refresh through a new lease gives you access to the latest features without a large capital outlay. It also allows you to reassess your printing volume and needs to ensure your new agreement is a perfect fit.

Some companies offer month-to-month renewals as a temporary solution if you need more time to decide, but these are typically more expensive than your original rate. Be cautious of early upgrade offers that roll remaining payments into a new agreement. This practice means you finance old debt with new equipment and usually costs more in the long run. It’s almost always better to complete your current term before starting a new lease.

Frequently Asked Questions about Copier Leasing

We’ve gathered the most common questions about copy machine lease options to help you move forward with confidence.

How do I compare different copier leasing options?

To compare providers effectively, start by requesting transparent pricing. A reputable company will provide an all-inclusive quote detailing the monthly lease rate, cost-per-copy charges, and what the maintenance agreement covers. If a provider is not forthcoming with this information, it’s a red flag.

Check customer reviews and testimonials to gauge service quality and reliability. Look for companies with a strong, positive track record in your area. Ask about guaranteed service level agreements and response times, as quick support is essential to minimize downtime.

Ideally, your maintenance agreement should be separate from your lease. When bundled, the entire payment can be subject to annual increases. A separate agreement provides more control and negotiating power over service and supply costs.

Can I get out of a copier lease early?

Exiting a copy machine lease early is typically difficult and expensive. Lease agreements contain a termination clause that outlines the penalties, which are often substantial. You may be required to pay all remaining payments plus additional fees.

Some leases offer an early buyout option, but this is rarely a cost-effective solution. Be wary of vendors offering an “early upgrade” by rolling your remaining balance into a new lease. This practice means you are financing old debt and will almost always cost you more. It is better to complete your current lease term before starting a new one.

How does a copy machine lease impact my business taxes?

The tax implications can be favorable. Monthly lease payments are generally considered operating expenses, allowing you to deduct the full amount each year. This spreads the tax benefit over the lease term.

Maintenance and service fees are also typically deductible. If you were to purchase instead, Section 179 of the IRS tax code might allow you to deduct the full equipment cost in the year of purchase, offering a larger upfront deduction.

Tax laws are complex and vary based on your business. We always recommend consulting a qualified tax professional for advice specific to your financial situation.

Conclusion

Choosing the right copy machine lease comes down to understanding your options and aligning them with your business needs. A lease offers financial flexibility and predictable costs, giving you access to modern technology without a large upfront investment and bundling maintenance for peace of mind.

As you decide, remember these key steps: assess your true print volume to avoid overpaying, read the fine print to understand clauses like automatic renewals, and don’t hesitate to negotiate terms. Always consider the total cost of ownership, including potential overage fees, not just the monthly payment.

Whether a 36-month lease for frequent tech refreshes or a 60-month term for lower payments suits you best, the goal is a solution that fits your budget and workflow. At Barlop, we are committed to helping you find the right copy machine lease for your unique business needs.

Find the right copier lease for your business