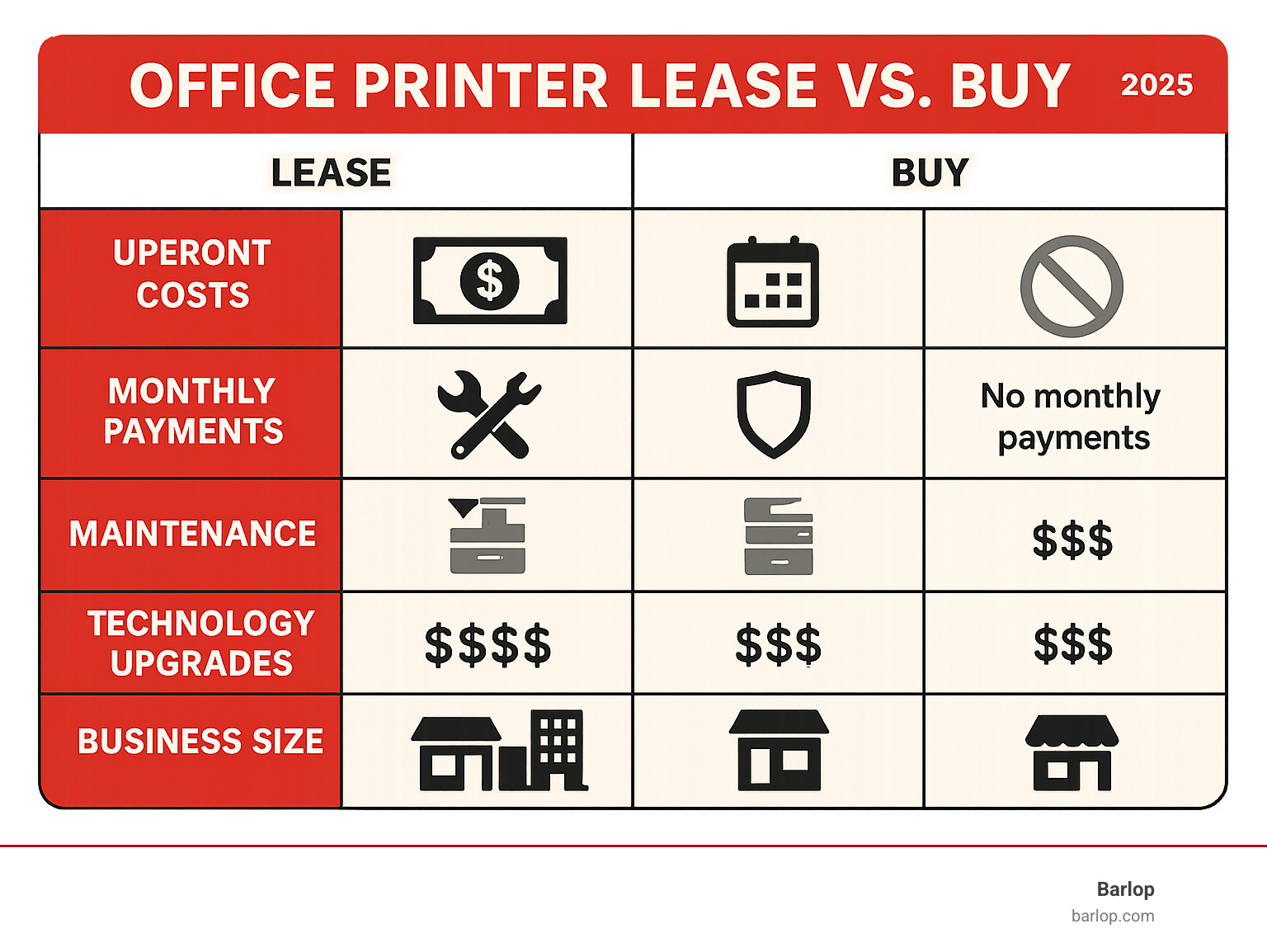

An office printer lease can be a smart financial move, but it’s not always the right choice. Here’s a quick overview:

Key Benefits of Leasing:

- Lower upfront costs ($100-$900/month vs. $13,000+ to buy)

- Maintenance and repairs included

- Easy technology upgrades

- Predictable monthly expenses

- Tax-deductible payments

Key Benefits of Buying:

- Lower total cost over time

- Full ownership and control

- No usage restrictions

- Section 179 tax deductions

- Equipment resale value

For office managers in Miami dealing with outdated, unreliable printers, the decision between leasing and buying affects the budget, productivity, and daily operations. Large, multifunction printers are often necessary, but their purchase price is high. A new copier can cost $13,000, with heavy-volume models reaching $35,100.

Leasing offers an alternative, with monthly payments from $65 to $920, spreading the cost over time and often including maintenance. This guide will walk you through the costs, potential fees, and how to evaluate your business’s specific needs to make the right choice.

The Great Debate: Weighing the Pros and Cons of Leasing vs. Buying

Choosing whether to buy a replacement printer or sign an office printer lease is a strategic decision that impacts your cash flow and long-term growth. For any business in Florida, from a Fort Lauderdale startup to an established Miami company, it’s crucial to understand both options. The right approach depends on your company’s financial goals and operational needs.

The Case for Buying: Ownership and Long-Term Value

Buying a printer means it’s a company asset. The primary benefit is a lower total cost over time. While the initial price can be high—around $13,000 for a new copier and up to $35,100 for heavy-duty models—once it’s paid for, there are no more monthly equipment payments.

Ownership also provides full control. There are no usage restrictions or overage fees, which is ideal for businesses with high or unpredictable print volumes. Tax benefits are another advantage. Section 179 of the tax code allows businesses to deduct the full purchase price of qualifying equipment in the year it’s acquired, offering significant savings. Finally, the printer is an asset on your balance sheet that can be sold later, with used copiers fetching an average of $5,800.

The downsides include the high upfront cost, which can strain a budget, and the responsibility for all maintenance and repair costs. Plus, the technology may become outdated within a few years.

The Case for Leasing: Flexibility and Predictable Costs

An office printer lease focuses on access rather than ownership. The most significant advantage is the low initial investment. Instead of a large purchase, you have predictable monthly payments, typically from $65 to $920, which preserves capital for other business needs.

Most lease agreements include maintenance and repairs, eliminating surprise bills. The leasing company handles routine service and emergency repairs, and often includes supplies like toner. Technology upgrades are also simple; at the end of the lease term, you can easily swap the old machine for a new model, ensuring you always have current technology with better security and efficiency. Leasing also offers scalability, allowing you to adjust your equipment as your business grows or changes.

The main drawbacks are a potentially higher total cost over the long term and being locked into a contract, usually for 36 to 60 months. Exceeding monthly page limits can also lead to expensive overage charges. The choice comes down to whether you prioritize long-term cost savings and asset ownership or flexibility and predictable expenses.

A Deep Dive into the Financials: Cost and Tax Implications

The financial details of an office printer lease versus buying are critical. The decision involves more than the purchase price or monthly payment; it includes maintenance, supplies, tax benefits, and cash flow considerations that affect your bottom line.

Comparing the Total Cost of Ownership (TCO)

The Total Cost of Ownership (TCO) includes every expense related to the printer over its life. When buying, you have the upfront purchase price ($4,000 for a used model to over $35,000 for a new one), plus ongoing maintenance ($1,500-$3,000 over three years) and supplies. The cost is offset by the printer’s resale value, which can be around $5,800 for a used copier.

With a lease, costs are predictable monthly payments that often bundle maintenance, repairs, and sometimes supplies. However, the total cost over the lease term may be higher, and you must watch for overage fees if you exceed print limits.

For a detailed breakdown of how TCO is calculated across industries, you can review the Total cost of ownership entry on Wikipedia.

Here’s a sample 3-year TCO for a mid-range multifunction printer:

| Category | Buying (3 years) | Leasing (3 years) |

|---|---|---|

| Upfront Purchase Price | $13,000 (new 55 ppm copier) | $0 (initial outlay) |

| Monthly Payments | $0 | $18,000 (avg. $500/month × 36 months) |

| Maintenance & Repairs | $1,500 – $3,000 (estimated) | Included (often bundled) |

| Supplies (Toner/Ink) | $1,000 – $2,000 (estimated) | Often included or billed per page |

| Overage Fees | N/A | Variable (if volume limits exceeded) |

| Disposal/Resale Value | −$5,800 (estimated resale of used copier) | $0 (return equipment) |

| Estimated Total Cost | $9,700 – $11,200 | $18,000+ |

Cash Flow and Budgeting Impact

Leasing is excellent for preserving cash flow. It turns a major capital expenditure into a manageable operating expense, freeing up capital for marketing, inventory, or hiring. The predictable monthly payments, which usually include maintenance, make budgeting simpler and prevent surprise repair bills.

Buying involves a large initial cash outflow and unpredictable maintenance costs. While it may save money long-term, you must budget for unexpected repairs.

Understanding the Tax Implications

Tax implications can influence the decision. With a lease, monthly payments are typically 100% tax-deductible as a business expense, reducing your taxable income.

When buying, you can’t deduct the full price at once but can claim depreciation over the equipment’s life. Section 179 offers a significant benefit, allowing you to deduct the full purchase price in the year of acquisition, up to certain limits. This can provide a large tax benefit in year one.

The best choice depends on your financial situation. Some businesses prefer the consistent deductions from leasing, while others benefit from the large upfront deduction of buying. Consulting with an accountant is always recommended to determine the best strategy for your business.

Decoding Your Office Printer Lease Agreement

An office printer lease agreement is the foundation of your relationship with the leasing company. Understanding its contents can save you from surprise costs and future headaches, whether your office is in Miami or Fort Lauderdale.

What’s Typically Included in an office printer lease?

A lease is more than just the equipment. It’s a solution that bundles services into a monthly payment.

- Equipment: The agreement specifies the printer model, its speed (pages per minute), and paper handling capabilities.

- Maintenance and Repairs: This is a key benefit. The leasing company is responsible for fixing paper jams, broken parts, and routine service, preventing unexpected repair bills.

- Service Level Agreements (SLAs): These define response times for service calls and uptime guarantees, which is critical for business continuity.

- Supplies: Many leases include toner and ink, delivered based on usage. Paper and staples are almost always your responsibility.

- Installation and Training: The leasing company usually handles delivery, network setup, and basic training for your team.

Typically, the leasing company covers toner, parts, labor, and support. You are responsible for paper, staples, and damage from misuse.

Key Terms and Conditions to Scrutinize

Pay close attention to these details in your lease agreement, as they can significantly impact your costs and experience.

- Lease Duration: Usually 36 to 60 months. Longer terms have lower monthly payments but lock you into technology for longer.

- Page Volume and Overage Charges: Leases include a set number of pages per month. Exceeding this limit results in per-page charges that can be costly.

- Early Termination Penalties: Ending a lease early can be expensive, often requiring payment of the remaining balance.

- Evergreen Clauses: These automatically renew your lease if you don’t provide written notice (a Letter of Intent) 90-120 days before expiration.

- Insurance: Many leases require you to insure the equipment against loss or damage.

Consider keeping the maintenance agreement separate from the lease. This provides more control to negotiate costs and avoid hidden fees or automatic annual increases.

The End of the Line: What Happens When Your Lease Expires?

Planning for the end of your lease is crucial. You have several options:

- Return the Equipment: The most common option. You must provide a Letter of Intent 90-120 days prior to the lease end to avoid automatic renewal.

- Purchase the Equipment: You can buy the printer at its Fair Market Value or, in some cases, for a $1 buyout fee.

- Renew the Lease: You can continue using the same equipment, often at a lower monthly rate.

- Technology Refresh: Upgrade to a newer model with a new lease agreement. This is a popular choice for staying current with technology.

Start discussing these options with your leasing company well before the expiration date to make an informed decision.

Making the Right Choice for Your Business

The right choice between an office printer lease and buying depends entirely on your business’s unique situation. The key is to assess your needs thoroughly.

Key Factors to Guide Your Decision

Consider these factors when making your choice:

- Business Budget: If preserving cash is a priority, the low upfront cost of a lease is attractive. If you have solid cash reserves, buying may be preferable.

- Monthly Print Volume: High-volume businesses may find ownership more cost-effective to avoid lease overage fees. For moderate volumes, the predictability of a lease is beneficial.

- Technology and Security Needs: If you require the latest features and security protocols, leasing provides a simple upgrade path every few years.

- Growth Projections: Leasing offers the flexibility to scale your equipment up or down as your business evolves.

- In-house IT Support: If you lack a dedicated IT team, the included maintenance and repair services with a lease can be a significant advantage.

The Role of the Technology Lifecycle

Printer technology evolves quickly. Modern devices offer advanced security, greater energy efficiency, and better integration with cloud and mobile services. This rapid advancement can make purchased equipment feel outdated in just a few years.

Leasing helps mitigate technology obsolescence. At the end of your lease, you can upgrade to the latest model, ensuring your business benefits from current technology. This flexibility is essential for staying competitive and secure in today’s business environment.

Frequently Asked Questions about an office printer lease

Business owners across Florida often have similar questions about printer leasing. Here are answers to some of the most common concerns.

How much does it cost to lease an office printer?

The cost to lease a printer varies based on your needs. A basic black and white machine for light use can be as low as $65 per month. Heavy-duty color copiers with advanced features can range from $195 to $920 monthly. Most businesses find their needs met with plans between $100 and $500 per month. The final cost depends on the printer model, color capabilities, monthly print volume, and the included service agreement. A comprehensive service package increases the monthly cost but provides value by covering toner, parts, labor, and support, eliminating surprise repair bills.

Is it better to have the maintenance agreement included in the lease payment?

Bundling the maintenance agreement into the lease payment offers simplicity with one monthly bill. However, it can reduce your flexibility and negotiating power. Bundled agreements may include automatic annual price increases of 10% or more.

We often recommend keeping the maintenance agreement separate. This gives you more control to negotiate terms, lock in rates, and adjust service levels as your needs change. It also helps you avoid hidden fees for things like service call trip charges or supply shipping.

Can I get out of an office printer lease early?

Yes, it’s usually possible to exit an office printer lease early, but it typically involves a penalty. Most agreements have an early termination clause that requires you to pay some or all of the remaining payments. This protects the leasing company’s investment.

Some companies may offer a buyout option, allowing you to purchase the equipment. It’s always best to have an open conversation with your leasing provider about your changing needs. Be cautious of offers that roll your remaining debt into a new lease, as this can be more expensive in the long run.

Conclusion: Is Leasing the Right Move for Your Office?

There is no single right answer to the lease-versus-buy question. The best choice depends on your specific business situation. For an established company with steady cash flow, buying can make sense for long-term savings and asset ownership, especially with the Section 179 tax deduction.

However, for many businesses, particularly those that are growing or cash-flow conscious, an office printer lease offers clear advantages. It preserves capital, includes maintenance, provides easy technology upgrades, and offers predictable monthly expenses. Consider your business’s future: do you need flexibility, scalability, and access to current technology? An office printer lease ensures you aren’t left with an outdated machine that could be inefficient or a security risk.

Partnering with the right provider is key. A good partner will understand your needs, explain the details, and provide ongoing support to find a solution that helps your business run smoothly.

Review your budget, print patterns, and business goals. Weigh the importance of flexibility against long-term cost savings. The perfect printing solution is the one that aligns with your priorities.

Find the perfect office printing solution for your business.