Copier leases are a popular solution for businesses wanting to upgrade office equipment without large upfront costs. Instead of paying $10,000-$50,000 for a new copier, companies can make monthly payments over 36-60 months, preserving capital for growth.

Here are some key facts about copier leases:

- Monthly payments range from $75-$750 depending on the equipment.

- The two main types are Fair Market Value (FMV) and $1 Buyout leases.

- Standard terms are 36-60 months with options to upgrade, renew, or purchase.

- Most leases require little to no money down.

- Maintenance and service can be bundled or kept separate.

- Tax benefits differ for operating leases (expensed) and capital leases (depreciated).

The challenge is choosing the right lease structure. Dealers may push longer terms or bundle maintenance, which can increase costs. For office managers in Miami, managing budgets and minimizing downtime are key pressures. As one expert notes, “Copier leasing can become an anxiety ridden task if you don’t know how it works.”

This guide will help you compare leasing, renting, and buying. You’ll learn to negotiate terms, avoid hidden fees, and choose the best option for your business.

Copier Leases 101: How They Work

A copier lease is a long-term rental agreement, typically 36 to 60 months, that lets you use professional-grade equipment without a large upfront investment. It’s like leasing a car for your office, preserving capital while accessing necessary technology. The process begins when a dealer submits your business information to a leasing partner for underwriting to evaluate creditworthiness.

You have two main lease structures. Fair Market Value (FMV) leases, or operating leases, have lower monthly payments because you’re paying for usage, not ownership. At the end of the term, you can return the copier, renew, upgrade, or purchase it at its fair market value. This is ideal for businesses that want the latest technology. In contrast, $1 Buyout leases, or capital leases, have higher monthly payments that cover the equipment’s full cost plus interest. At the end of the term, you own the copier for just $1. This suits businesses planning to keep the equipment long-term.

Credit requirements vary, and newer businesses may need to provide a personal guarantee, which is standard practice. It’s wise to wait until the equipment is installed and working correctly before signing the final acceptance, as your payment schedule begins after this approval. End-of-term options offer flexibility, with many businesses choosing to upgrade to newer models.

For more details, see our copier and printer lease resources.

Understanding the key players and documents in copier leases helps the process go smoothly. The lessor is the financing company that owns the equipment and collects payments. You are the lessee, the business using the equipment. Your dealer sells and installs the copier and usually handles maintenance.

The service agreement is a separate contract for maintenance, repairs, and supplies. Keeping it separate from the lease can save you from paying interest on future service costs. Also, be aware of the Letter of Intent, a formal notice sent 90-120 days before the lease ends, stating your plans to return, renew, or purchase. Missing this can trigger automatic renewals, often due to an evergreen clause. Always negotiate to remove or limit these clauses.

To speed up your lease application, have the necessary documents ready. Most applications require your official business name and contact information. A DUNS number helps established businesses, while bank and trade references demonstrate financial stability. Newer businesses may need to provide financial statements and personal identification from the owners. Having these documents prepared can shorten the approval process from weeks to days.

Lease vs Rent vs Buy: Choosing the Right Path

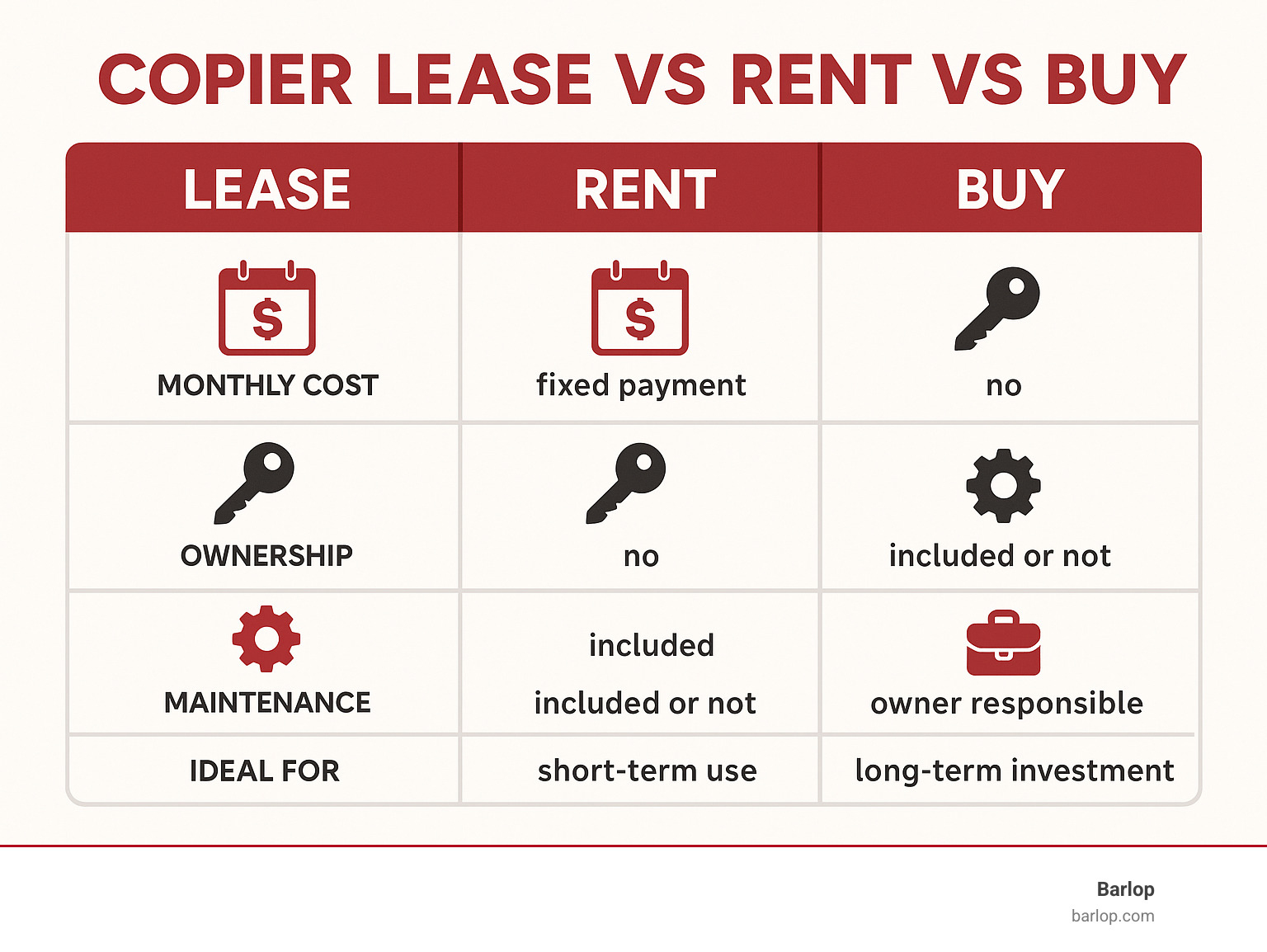

Choosing between leasing, renting, or buying a copier is like choosing transportation in Miami; each option suits different needs.

Leasing is a middle-ground approach with predictable monthly payments ($75-$750) over 36-60 months. You get modern technology without a large initial investment and can upgrade when the lease ends. These payments are often treated as tax-deductible operational expenses.

Renting is a short-term solution, ideal for temporary projects, seasonal spikes, or events. Rental periods can be as short as a day or last several months, and typically include delivery, setup, maintenance, and pickup.

Buying means you own the equipment outright, paying the full price upfront or financing it. This requires significant capital but can be the most economical choice if you plan to keep the machine for over five years and don’t need frequent upgrades.

Here is a comparison of the three options:

| Feature | Lease | Rent | Buy |

|---|---|---|---|

| Commitment | Medium to Long-term (36-60 months) | Short-term (days to months) | Long-term (ownership) |

| Upfront Cost | Often $0 | Low (daily/monthly fee) | High (full purchase price) |

| Ownership | No (Lessor owns) / Yes ($1 buyout) | No (Rental company owns) | Yes (You own) |

| Technology | Easy to upgrade | Highly flexible | Stays current only if you upgrade |

| Maintenance | Typically separate service agreement | Usually included | Your responsibility (contract or DIY) |

| Ideal Use | Consistent, long-term needs, capital conservation | Temporary projects, events, seasonal peaks | Stable, high-volume, long-term use |

Leasing is the choice for over 80% of businesses, but it has pros and cons. The main advantage is capital conservation. You avoid a large upfront cost, freeing up cash for other business needs. Leases also offer predictable monthly expenses, making budgeting easier, and provide access to current technology through end-of-term upgrades. However, the total cost of leasing is often higher than buying due to interest and fees. You also don’t build equity unless it’s a $1 buyout lease. Be mindful of overage charges for exceeding print volume limits and steep penalties for early termination. For more on leasing fundamentals, you can refer to Scientific research on leasing basics.

In some cases, renting is better than leasing. It’s perfect for events like trade shows in Fort Lauderdale, where you need equipment for a defined period. It’s also ideal for handling document overflow during peak times, such as tax season for accounting firms. Construction companies find rentals suitable for temporary job sites. For new businesses with uncertain print volumes, renting allows you to gauge your needs before committing to a long-term lease.

Purchasing is the smartest choice in certain scenarios. High-volume operations with stable workflows may find buying more cost-effective in the long run. If you plan to use the copier for more than five years, purchasing becomes more economical over time. Businesses with strong cash flow can avoid financing charges by buying outright. You also gain depreciation benefits, including potential Section 179 deductions.

Understanding Copier Lease Costs, Terms & Hidden Fees

The advertised monthly payment for a copier lease is just the starting point. The true cost includes several components that can lead to surprises if you’re not prepared.

Your base monthly payment is calculated from the equipment’s MSRP and a lease rate factor, which depends on the lease type, term length, and your credit. However, this often excludes other costs. For instance, the leasing company requires insurance on the equipment and passes the cost to you as a monthly fee. You may also be responsible for return freight costs when the lease ends, which can be several hundred dollars. Property tax is another pass-through cost that the leasing company pays but bills to you.

Maintenance and service agreements are crucial but should be handled carefully. Bundling maintenance into your lease payment means you’ll pay interest on future service. We recommend keeping the maintenance contract separate to avoid this extra cost. Also, watch for maintenance escalation clauses that allow for annual price increases, sometimes up to 10%. Other potential costs include administrative fees and overage charges for exceeding your monthly print volume.

Our managed print services can help you steer these costs. You can learn more at More info about Managed Print Services.

To break down the numbers in copier leases, you should understand a few key financial components. The equipment MSRP is the starting point for payment calculations. A portion of each payment is interest, the leasing company’s financing fee. Residual value is the copier’s estimated worth at the end of an FMV lease. Overage charges apply when you exceed your contracted print volume. Unused prints typically do not roll over, so accurate volume estimation is critical.

When it comes to negotiating better copier leases, every business has leverage. Consider the term length carefully; longer terms lower monthly payments but increase total cost. Push to remove or cap annual increases in your maintenance agreement. As mentioned, keeping service separate from the lease saves money. Insist on a performance guarantee that requires the dealer to replace a consistently malfunctioning copier at no cost. For businesses with multiple locations in Miami-Dade or Broward, co-terminus leases simplify management by aligning all lease end dates. If you need to upgrade early, your dealer may offer a buyout of your remaining balance, especially if you have a good payment history. Before signing, demand a detailed breakdown of all potential fees and get any verbal promises in writing.

Maximizing Value & Avoiding Pitfalls in Copier Leases

You’ve signed your copier lease and the equipment is humming along nicely in your office. But your work isn’t done yet. The real art of copier leasing lies in managing that relationship throughout the entire term. Think of it like tending a garden – a little attention along the way prevents big problems later.

Conduct quarterly usage reviews to stay ahead of your printing needs. This helps you adjust your copy allotments with your service provider, avoiding costly overage charges during peak seasons. As your lease nears its end, timing is crucial. Send a letter of intent 90 to 120 days before expiration to state your plans to return, renew, or purchase the equipment. This prevents automatic renewal, which could lock you into another year of payments.

If your copier malfunctions, contact your service provider immediately. For businesses where downtime is not an option, ask about loaner units when you sign the lease. For managing multiple locations across South Florida, co-terminus leases are beneficial, as they synchronize all lease end dates for easier negotiation and upgrades.

At the end of your lease, consider data security and environmental responsibility. Ensure the copier’s hard drive is securely wiped to protect your business data. Many dealers offer certified recycling programs for old equipment.

When a copier lease ends, you have several options. If you’re returning the equipment from an FMV lease, you are typically responsible for arranging and paying for return shipping. Inspect the copier for excessive wear and tear to avoid charges. Many businesses choose to upgrade to a newer model, gaining access to the latest technology. Your dealer can roll any remaining obligations into the new lease. Alternatively, you can purchase your current copier at its fair market value, which is often negotiable. For $1 buyout leases, you simply make the final payment to own the equipment.

Mid-term strategies for active copier leases offer flexibility if your business needs change. Lease transfers may be possible if you sell your business, pending credit approval of the new party. You can often add accessories like paper trays or software features by rolling the cost into your current lease payments. If you provided a personal guarantee, a history of on-time payments might allow you to negotiate its removal. If an early upgrade is necessary, work with your dealer to minimize penalties through manufacturer incentives or loyalty benefits.

Frequently Asked Questions About Copier Leases

Throughout our years of helping businesses steer copier leases, we’ve noticed the same questions come up time and time again. Whether you’re a startup in Miami or an established company in Fort Lauderdale, these concerns are universal. Let’s address the most common ones to help clear up any confusion.

What costs are included in a copier lease?

Your monthly lease payment primarily covers the equipment cost itself plus the interest charged by the leasing company. Think of it like a car payment – you’re paying for the vehicle and the financing.

However, what catches many businesses off guard are the costs that are typically excluded from your monthly payment. Maintenance and repairs are usually separate, along with supplies like toner, parts, and labor. You’ll also likely face additional charges for insurance pass-through (since the leasing company owns the equipment), property taxes, delivery and return freight, and various administrative fees.

While some dealers might try to bundle maintenance into your lease payment, we generally recommend keeping it separate. Why? Because bundling means you’re paying interest on future prints, which can significantly increase your overall cost. It’s like paying interest on groceries you haven’t bought yet.

Always ask for a detailed breakdown of all potential costs – both what’s included in your monthly payment and what you’ll need to budget for separately. This transparency helps you avoid unpleasant surprises down the road.

Can I upgrade or change my copier during the lease?

The short answer is yes, but it comes with some financial considerations. Most copier leases do allow for upgrades or changes during the lease term, especially if you’re past the halfway point of your agreement.

Here’s how it typically works: the remaining balance on your current lease gets rolled into your new lease agreement. It’s similar to trading in a car before you’ve finished paying it off – you’re essentially carrying forward the old debt into the new arrangement.

While this flexibility sounds great, it does increase your overall cost. However, many dealers offer manufacturer incentives or loyalty benefits to help offset some of the financial impact, especially if you’re upgrading to a newer model through them.

The timing matters too. Upgrading very early in your lease term is more costly and less common than upgrading later. If you’re considering an upgrade, it’s worth having a conversation with your dealer about potential incentives and the best timing for your specific situation.

Is it possible to secure copier leases with less-than-perfect credit?

Absolutely, though it might require some additional steps. The leasing industry understands that not every business has perfect credit, especially newer companies that are still building their financial history.

For businesses operating for less than two years or those with credit challenges, leasing companies often require a personal guarantee from the business owner. This means you’re personally backing the lease payments if your business can’t make them. While this might feel uncomfortable, it’s a standard practice that opens doors for businesses that might otherwise struggle to get financing.

You might also face higher interest rates compared to businesses with stellar credit. Think of it as the leasing company’s way of managing their risk – they’re still willing to work with you, but at a slightly higher cost.

If your credit situation is particularly challenging, you have a couple of alternatives. Short-term rentals can be a good option while you build your business credit over time. Most leasing companies look for about two years of positive credit history before offering their best terms.

There are also specialized leasing companies that focus on higher-risk credits. While their rates might be higher, they can provide a pathway to getting the equipment you need while you strengthen your financial position.

The key is being upfront about your situation. A good dealer will work with you to find a leasing partner that fits your current circumstances while setting you up for better terms in the future.

Conclusion

Navigating copier leases doesn’t have to be an anxiety-ridden task. By understanding the different types of leases, their associated costs, and the nuances of negotiation, you can make a strategic decision that benefits your business’s bottom line and operational efficiency.

Whether you’re a burgeoning startup in Miami, an established enterprise in Fort Lauderdale, or a growing business across Broward and Florida, the right copier acquisition path can save you significant capital and keep your technology current. The goal is to optimize your document management, not just acquire a machine.

When making your decision, start by assessing your actual needs. How long do you realistically need the copier? What’s your estimated monthly print volume based on current usage patterns? Do you need the latest technology features, or will a reliable workhorse suffice? These questions will guide you toward the right path.

Next, understand the lease types available to you. Consider whether a Fair Market Value lease’s flexibility at the end of the term or a $1 Buyout lease’s clear path to ownership aligns better with your business strategy. FMV leases typically offer lower monthly payments but no guaranteed ownership, while $1 buyout leases cost more monthly but lead to equipment ownership.

Budget for all costs, not just the monthly payment you see in the proposal. Account for monthly payments, maintenance agreements, taxes, insurance pass-throughs, and potential end-of-term fees like return freight. These “hidden” costs can add up quickly if you’re not prepared for them.

Negotiate smart by challenging automatic annual increases on maintenance agreements, keeping your service agreement separate from the equipment lease, and securing performance guarantees in writing. Don’t be afraid to push back on unfavorable terms – many aspects of copier leases are more negotiable than dealers initially let on.

Finally, plan for the end of your lease term from day one. Know your options whether you want to return, renew, upgrade, or buy out the equipment. Most importantly, mark your calendar to send that Letter of Intent 90-120 days before your lease expires to avoid automatic renewals.

We understand that every business is unique, and sometimes, a little expert guidance can make all the difference. For more in-depth information and personalized advice on finding the perfect copier lease solution for your business, we invite you to explore our resources on More info about Copier & Printer Lease. We’re here to help you make the most informed decision for your business.

At Barlop, we bring one-stop leasing expertise to businesses throughout South Florida. Our goal is to simplify the process and ensure you get the best possible terms for your specific situation. Because when it comes to copier leases, knowledge truly is power.